| University | Murdoch University (MU) |

| Subject | BUS303: Taxation |

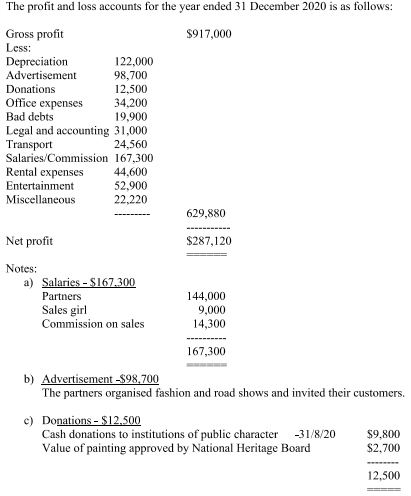

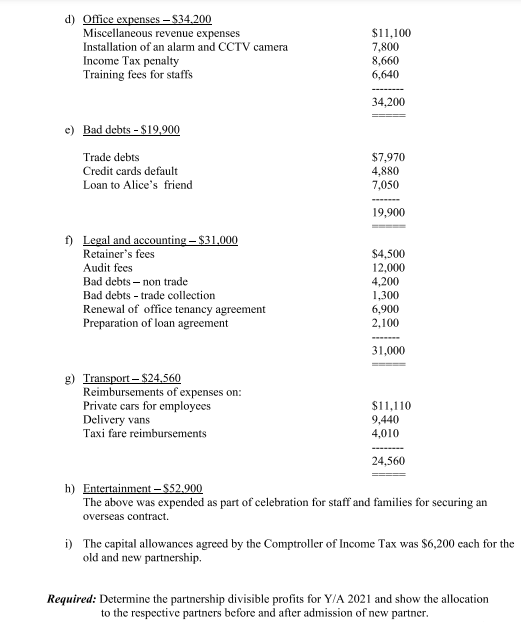

Question.1 Rashid and Alice are friends from Singapore Polytechnic and have been doing fashion designing since graduation and started a boutique at Orchard Road. They are each paid a monthly salary of $5,500. They had only one employee, Sharon aged 27 who is the salesgirl. They decided to admit Sharon as an equal partner from July 2020. Sharon has been receiving a monthly salary of $1,500 per month but after 1 July 2020, it will become $2000 per month.

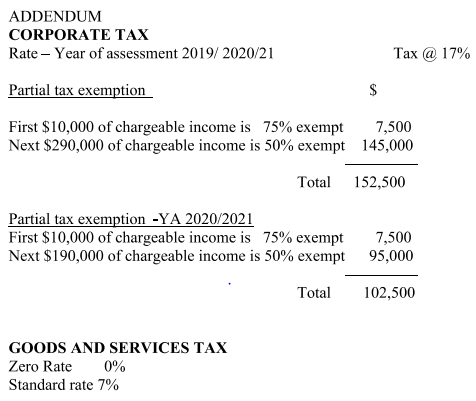

Question 3. Deaf Aids Pte Ltd is a Singapore-registered company and a tax resident in Singapore. It carries business on the trading of all types of hearing aids and accessories and is a GST registered trader.

For its financial year ended 31 December 2020, Deaf Aids Pie Ltd has reported a net accounting profit of 5251.000 after charging depreciation of 545.500: the only item reflected in its accounts that were not tax-deductible.

In the last quarter ended 31 December 2020, Deaf Aids Pre Ltd:

a) Sold hearing aids amounting to $2 million (before GST) of which 25% were exported directly to Indonesia

b) It includes an input GST of $136,500 on purchases of trading stock.

c) In addition, Deaf Aids Ptc Ltd acquired during the last quarter the following items of plant and machinery, all from GST registered traders except the photocopier, which was purchased from a non-registered trader.

Description Cost (inclusive of GST)

Computers $5,564

Photocopier $2,700

Conference table $1,476.60

Machinery $10,914

In the same quarter, Deaf Aids Pte Ltd also sold an antique vase (purchased in 2014) at its net book value of $37,450 (inclusive of GST). The sale was made on 30 November 2020. The vase was not subject to a capital allowance claim.

Required:

a) Compute the minimum chargeable income of Deaf Aids Pte Ltd for the year of assessment 2021 assuming the tax written down values on I Jan 2020 were nil.

Further, assume the firm is not existing the low-value asset and 2 stars write off conical allowances.

b) Compute the amount of input and output CST reported by Deaf Aids Pte Ltd in its GST return for the quarter ended 31 December 2020 together with the amount of net GST payable/refundable for that quarter.

c) “GST applies to all transactions that are sourced in Singapore except out of scope supplies”. Explain what is meant by out-of-scope supplies.

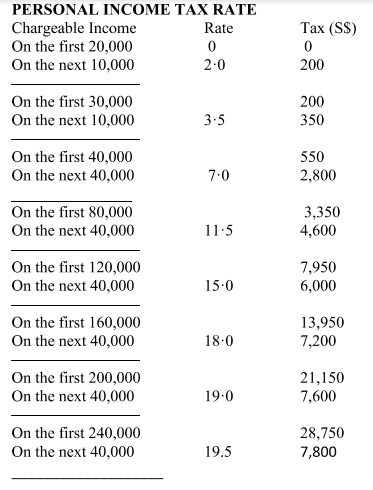

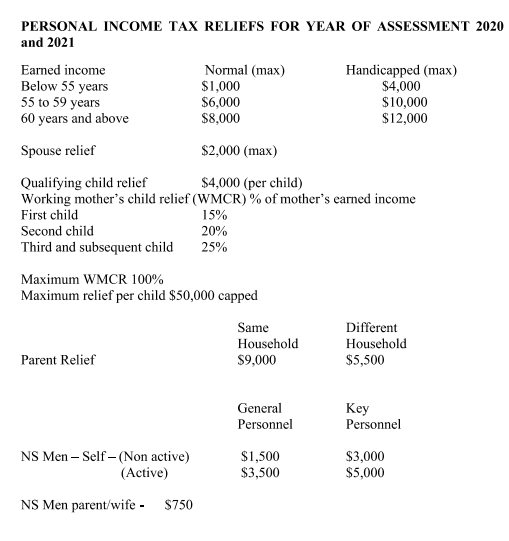

Question 4: Priscilla Lim, a Singaporean aged 35 is married with 2 schooling children. She is working in Melbourne, Australia since the beginning of 2019. She has not filed any tax return to Inland Revenue of Singapore (IRAS) since then. She has the following income for the calendar year 2020.

I) Priscilla has inherited a property from her late grandfather in 2017 which was a bungalow in Mountbatten Road. Singapore. She sold the property for S1.2 million in August 2020 and paid 2% of the sales value as agent fees. She has not sold any property in Singapore ever before.

2) Employment income of 5140,000 was paid to her via an approved bank of Singapore account by her Australian-based employer. The interest derived from this account was $550 for the current year.

3) Priscilla owns another property at Marine Parade and earned a rental income of $2000 per month. The rental price had declined due to low demand during Covid 19 pandemic crisis. The property was rented from January 2020 until 31 December 2020. However, the deductible rental expenses were $2,400 per month. As a result, she had made a rental loss.

Required:

i) For each of the receipts (I) to (3). advise Priscilla Lim of the Singapore tax implications and on whether she can offset her rental loss against her other income.

ii) Advise Priscilla Lim with regards to tiling of the tax return in Singapore and the consequences of defaulting it;

b) From a Singapore tax perspective: i) Explain what do you understand by the term accommodation benefit given by employers and its implications on tax for a foreign employee and his, her family members assuming there is no information on rental provided by the employer?

What are the differences between partly and fully furnished benefits? Cite relevant examples for each.

Question 5: Picket Fence is a registered company established in the year 2014 and it’s doing business in constructing fences for households, public car parks, and commercial buildings.

That are only 10 employees in this firm out of which 3 are Singaporeans and the balance are foreign workers. All employees have been working since the commencement of the business. The following information relates to the current year 2020 of the 3 Singaporean employees.

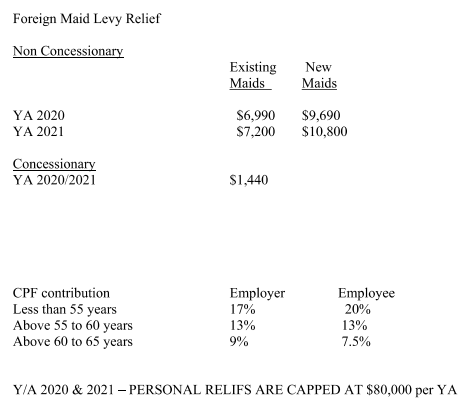

David Lim (Director) — aged 63 — salary per month 57.900;

Ken Tan (Manager) —aged 27 — annual salary of S114.000

Zainal Osman (Field supervisor) — aged 52 – monthly salary of 59.100. Resigned on 1′ October 2020.

Due to Covid 19 pandemic crisis, the business was severely hit. There was a pay cut of 10% across all employees from May 2020 onwards.

The accounts assistant. Ms. Jenny Sim (foreigner) was inexperienced and did not adhere to the statutory CPF contributions under the Singapore CPF ACT. The CPF was computed based on the salaries received.

Required:

a) Compute the CPF contributions for each employee by both employer and employee based on the statutory capping;

b) What are the tax implications of Mr. Ken Tan and Picket Fence company for defaulting the statutory rates?

c) Why are other employees not subject to CPF contributions?

Buy Custom Answer of This Assessment & Raise Your Grades

Do you need urgent assignment help on BUS303: Taxation Assignment. Then you are right destination Singapore assignment help offer most proficient taxation experts who provide high-quality help on international taxation assignment and they also committed to offering you unique answer in taxation subjects designed by our academic writers.

Looking for Plagiarism free Answers for your college/ university Assignments.

- Liam’s Employment Status & Contractual Obligations at Eclipse Marketing : SUSS

- PSB6014CL Individual Written Report Coventry University January 2025 : Project Management

- BUS352 Group-based Assignment January 2025 Semester SUSS :Operations Analytics

- BUS356 Group-based Assignment January 2025 Semester : Business Negotiation

- TZU CHI SCHOOL Term 3 Argumentative Essay Assessment 2024-25 : Historical Accuracy of ‘The Boy in the Striped Pajamas’

- PSB6012CL Course Work :Business Research Methods Key Approaches and Applications

- Article : Cell Biology and Molecular Regulation Rb–E2F Activity and Proliferation Commitment

- Workplace Law Assignment: Employment Status and Contractual Obligations

- Management Foundation Studies: Individual Assignment 2 Accounting & Business Finance SIM Global Education

- HRM335 Tutor-Marked Assignment (TMA01) January 2025 SUSS : Leadership Development