| University | Management Development Institute of Singapore (MDIS) |

| Subject | MGT204 Corporate Finance and Portfolio Valuation |

Individual Assignment

LO1: Compare and contrast a range of theoretical models that underpin

corporate finance and portfolio valuation decision-making.

LO2: Apply, analyse, and interpret how financial data influences financial

decision-making.

LO3: Critically reflect upon how financial decision-making tools and

techniques impact upon the value of a portfolio.

Attempt Either Part A or Part B

Part A – 100%

You have recently joined the investment team as a financial analyst at Lioncity Pte Ltd, a financial advisory firm based within Singapore. As part of the initial duties, you have been asked by the Board of Directors to investigate the latest four-year performance of ONE of the companies listed on the Singapore stock exchange provided below, with the view to potentially invest (for medium term) future company funds into the chosen company:

- Singapore Airlines Limited

- Sheng Siong Group Limited

- Parkson Retail Asia Limited

- Asiamedic Limited

- Creative Technology Limited

- FJ Benjamin Holdings Limited

Required:

Select any ONE of the above companies.

- Covering a 4-year period, apply on key data of all three financial statements of your selected company varied analytical tools including ratios, horizontal and vertical analysis. Ensure your report includes visual aspects such as graphs and charts to depict (show or display) key information. (20 marks)

- Prepare a report for the Board of Directors of Lioncity Pte Ltd (a potential investor) analysing and evaluating the four-year performance in profitability and cash management as well as financial position of the chosen company as revealed by its financial statements. (20 marks * 3 parts = 60 marks)

- Provide evidence-based recommendation as to whether it is worth investing into the company in the 1st quarter of 2025 for medium term (around 3 to 5 years) future. (10 marks)

- Summarize limitations of your analysis. (10 marks)

In this section, students should demonstrate both knowledge and understanding of a range of topics, theories, and concepts covered within the MGT204 Corporate Finance & Portfolio Valuation module. A report format should be utilized that offers clear, concise analysis, resulting in the production of robust recommendations. You should choose to analyse approximately 3 topics from the syllabus including the key performance indicator of share price analysis / fluctuations / key events. Further topics and concepts that can be considered for inclusion within the report include financing strategies, investment strategies, capital structure alterations, dividend policies, financial ratio analysis and merger and acquisition activities.

This is not an exhaustive list and students should be prepared to investigate other key aspects from the module if they feel necessary.

Total for Part A – 100 marks

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Part B – 100%

You have recently obtained employment within the investment analysis team at Lioncity Pte Ltd, a financial advisory firm that makes regular investments in several STI companies’ ordinary shares that are listed on the Singapore Stock Exchange. Initially, you have been entrusted with S$1 million worth of company funds to invest over an 8-week timeframe.

As part of the initial investment portfolio, you are required to select five STI Singapore Stock Exchange listed companies and invest the funds equally within their ordinary shares. Furthermore, on a minimum of three (3) separate occasions within the 8-week timeframe, you have been asked to sell one of the investments and to reinvest the funds in a differing company that you have chosen.

Note: You can create a free of charge student account at Interactivebrokers.com

Required:

- Provide a report to the Board of Directors of Lioncity Pte Ltd that offers critical reflection and analysis of the decision-making process regarding the investments undertaken across the 8-week timeframe. The report should have a separate section for decision made at start of the portfolio and for each of the three changes made in the portfolio. (20 marks * 4 parts = 80 marks)

- Provide a meaningful conclusion detailing your learnings over the 8-week period. (20 marks)

Note: Provide a snapshot of the portfolio valuation before and after each change(s) and at end of the period. You will not gain or lose extra marks based on performance of the portfolio.

In this section, students should critically analyse and reflect upon the decisions taken regarding the investments made across the twelve-week timeframe. The decision-making process must be underpinned by relevant themes and concepts that are prevalent within the field of corporate finance and are covered within the modular content. The introductory section should provide a clear, robust rationale that clearly justifies and evaluates why the selected companies were chosen as part of the initial portfolio. Upon removing and adding to the portfolio, the student should offer clear justification for the choices undertaken and support this with relevant analysis and evaluation that draws upon a range of corporate finance topics. Upon adding a share to the portfolio, it must be retained within the portfolio for a minimum one-week duration.

It would be expected that the report would incorporate a range of charts, tables, and screenshots of portfolio performance to visually enhance the work. Within the recommendation / conclusion section, students should clearly identify and reflect upon the decisions undertaken and elaborate upon what they have learnt across the duration of the portfolio-based exercise. Students will not gain further marks based upon the portfolio performance, rather they should reflect upon the decisions undertaken during the simulated exercise.

Total for Part B – 100 marks

Buy Custom Answer of This Assessment & Raise Your Grades

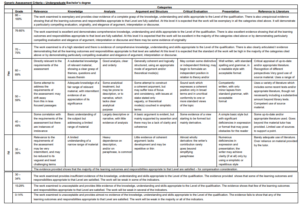

Generic Assessment Criteria – Undergraduate Bachelor’s degree

Looking for Plagiarism free Answers for your college/ university Assignments.

- LEGL2002 Enforceability of Contracts and Director Authority in Business Organisations

- HBC201 Exploring NEET Youth in Singapore: Factors, Challenges, and Reintegration Strategies

- EIPM: Sheng Siong Company Valuation Report – Investment Analysis & Recommendations, GBA 4

- ICT239 BMI App Development and Enhancement | ECA – SUSS

- FMT302 Facility Maintenance and Indoor Air Quality Management, ECA

- K-Pop Music Festival Poster Design | Assessment 2, Course Work

- Strategic Implementation of IBM’s Global Talent Analytics: Case study Analysis | Assessment 2

- HFS206 Occupational Biomechanics Assignment Question Papers – SUSS

- PSY205 Analyzing AI Bias: Prejudice in Language Technology and Its Impact in Singapore

- BPM203 Project Management Report: Residential Development on an Island (GBA01)