Managing Tommy’s Assets

Born in Medan, North Sumatra province, on 1 May 1950, Tommy Tan is the oldest of seven boys in his family. His father was an immigrant from Putian city in China’s Fujian province. In 1966, Tommy’s education was abruptly interrupted after Chinese schools were shut down by then-President Suharto’s new regime. He was prohibited from attending national schools

due to his parents’ Chinese citizenship.

When his father suffered a stroke, Tommy was left to run the family business, a small trading business importing all kinds of consumer goods into Indonesia. Noticing that Indonesia exported raw logs for conversion into plywood in countries like Japan or Taiwan, before importing the finished plywood back to Indonesia at great cost, Tommy recognized the opportunity and quickly set his heart on developing his own plywood mill in Indonesia.

However, he required a permit to do so. In Indonesia, permits were sought from politicians who often served as army generals. Tommy was forced to work with a general. The general was quickly convinced of the mill’s potential after seeing the completed factory and gave his blessings. Tommy knew that his factory would be a huge value-add to Indonesia’s economy and would result in the creation of many new jobs. The plant began operations in 1975 after being inaugurated by prominent political leaders. Slowly, from the plywood business, his company branched out into palm oil as well as pulp and paper. In 1997, Tommy elected to settle in Singapore with his family and also established his company’s headquarters in Singapore. Tommy is now one of the most prominent Indonesian Chinese residing in Singapore

with an estimated net worth of US$2.8 billion.

Despite being aged 70 today, Tommy is still hard at work and running his business empire with the help of his 3 children who have all grown up. Tommy is still constantly looking out for opportunities to grow his business empire and is fully aware of the need to manage and optimize capital so as to maximize his investment returns.

Tommy is a self-educated entrepreneur but regrets his interrupted education. He is an advocate of financial management theory and is willing to spend money on professional expertise to help him better manage and grow his business. Tommy has engaged your corporate advisory firm and seeks your inputs on the following financial management problems.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 1

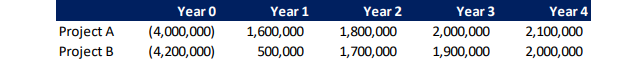

Mr. Tommy Tan is considering two potential investment projects that have similar capital requirements:

For Project A, the company cost of capital is assumed to be 14%. For Project B, assessed as the riskier project of the two, a risk-adjusted cost of capital of 15% is considered appropriate.

(a) Calculate the NPV of the two (2) projects and assess the projects using the investment appraisal technique of Net Present Value.

(b) Calculate the IRR of the two (2) projects and assess the projects using the investment appraisal technique of the Internal Rate of Return.

(c) Is the company’s cost of capital suitable in the evaluation of projects with different risks? Explain your answer. In the evaluation of previous investment projects, Mr. Tommy Tan notes that the IRR method can sometimes give multiple rates of return.

(d) Propose a common method that can be used to get around the problem of multiple rates of return. Explain the principles behind the proposed approach.

(e) What are the disadvantages of using the IRR method?

Question 2

Noting that there has been an increasing interest in organic foodstuffs with increasing affluence, Mr. Tommy Tan is considering starting an organic food retail business in Singapore. He targets to have 8 retail outlets island-wide by the end 2021. To maintain its target capital structure, the firm estimates that it will need to borrow $10 million to finance this growth. As the firm is tight on cash, it prefers to repay the loan in full only at the end of 10 years and only

wants to service the interest on an annual basis.

The firm has approached several banks in Singapore and 2 banks have signaled interest to be its main financier. JuneBank proposes an annual interest rate of 6.9% and the underwriting spread is 2%. BHR Bank offers the loan at an annual interest rate of 6.5% and the underwriting spread is 2.9%

(a) What is the effective cost of borrowing from JuneBank?

(b) What is the effective cost of borrowing from BHR Bank?

(c) Using the estimations in (a) and (b), determine the bank that the firm should borrow from.

Question 3

Besides running his own businesses, Tommy is also an avid stock investor and has a team of professional investment managers overseeing his stock portfolio. He’s trying to determine the fair value of a stock using a simple dividend discount model. Information on the stock is as follows: Macchiato Ltd is a famous coffee retail chain, and its stock traded at $42 at the beginning of

2016. Its beta estimate by a beta service company is 1 and it’s market risk premium is 6%. The risk-free rate at the end of 2015 was 1.6%. The firm was expected to pay dividends of $1.60 per share at the end of 2016 and 2017.

(a) Using the Capital Asset Pricing Model (CAPM), calculate the required rate of return.

(b) At what price do you expect Macchiato Ltd to sell at the end of 2017 if you forecast it will not pay the dividends as expected?

(c) At what price do you expect Macchiato Ltd to sell at the end of 2017 if you forecast it will pay the dividends as expected?

(d) Assume that Macchiato Ltd’s investors expect it to pay a dividend of $2.50 per share forever. Using the required rate of return calculated in (a) above, determine the value gained or lost per share by buying a share at $42.

(e) Macchiato Ltd traded at 4.5 times sales in 2015. It was reporting a net profit margin of its sales of 14 percent. What was it’s P/E ratio?

(f) Macchiato Ltd had 700,000 shares at the end of 2015. On January 23, 2016, it issued an additional 250,000 shares to the market at the market price of $42 per share. Assess the effect of this share issue on the price per share of the firm.

(g) On March 25, 2016, the directors of Macchiato Ltd decided to issue some new preferred stock. The issue will pay a $20 annual dividend per share, beginning 20 years from the date of issuance. If the market requires a 6% return on this investment, how should the preferred stock be priced on issuance?

(h) It is sometimes assumed in a two-stage dividend growth model that dividend growth drops from a high rate in the first stage to a low perpetual growth rate in the second stage. Comment on the reasonableness of this assumption and discuss what happens if this assumption is violated.

Question 4

(a) An investment advisor offers a product to Tommy that will deliver cash flows at the end of each of the next seven years. The first cash flow is $5 million and every year thereafter the cash flow will grow at a rate of 4%. If the annual interest rate is 2%, calculate the present value of this opportunity.

(b) To maintain a good relationship with the bank, Tommy is forced to deposit cash with the bank as collateral for loans to his businesses. At the end of each of the next 8 years, Tommy has to put $2.5 million cash in the bank. If the annual interest rate is 3%, what is the present value of this planned savings stream? What will be the balance in his bank account at the end of the 8 year period?

Question 5

Tommy is examining some risk-free Singapore government securities. The yields to maturity on three government bonds with maturities of 1, 2 and 3 years are respectively 3%, 4%, and 6%. The bonds all pay an annual coupon and have the same coupon rate of 1% and a face value

of $1,000.

(a) Calculate the prices of the three (3) bonds.

(b) (i) Calculate the expected 1-year interest rate for year 2.

(ii) Calculate the expected 1-year interest rate for year 3.

(c) Tommy does not understand why yields differ among Singapore government securities and when compared to the yields on securities issued by other governments. Explain why this might be the case.

Buy Custom Answer of This Assessment & Raise Your Grades

SingaporeAssignmentHelp.com assignment help experts will offer the best FIN303 financial management assignment help that will resolve all your queries related to any questions and present you with the best answers. Our experts provide university assignment help to the Singaporean students and help them score A+ grades.

Looking for Plagiarism free Answers for your college/ university Assignments.

- HRM331: Talent Management – Strategic Shift from the War for Talent to the Wealth of Talent

- Marginalised Populations – The Structural and Cultural Exclusion of People Experiencing Homelessness in Singapore

- CVEN3501 Assignment 2: Groundwater Modelling of Drawdown from a Pumping Bore

- CSCI312 Assignment 2: Conceptual Modelling and Implementation of a Data Warehouse and Hive Queries

- CH2123 Assignnment : Fugacity, VLE Modeling & Henry’s Law Applications

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- PSB501EN Assignment 1: Engineering Systems Integration: A Multi-Technique Approach to Mechanical Analysis

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Cinematic Dissection: Stylistic Elements and Their Thematic Significance

- Assignment: Transforming Talent in the AI Era: From War to Wealth through Ecosystem Innovation