| University | Singapore University of Social Science (SUSS) |

| Subject | Taxation |

SECTION A

QUESTION 1

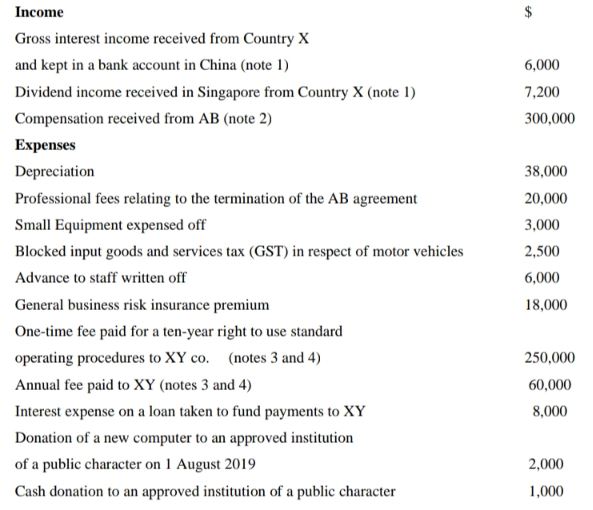

VKSS is a Singapore tax resident company. For its financial year ended 31 December 2019, VKSS recorded a net profit before tax of $800,000 after crediting/charging the following items:

Notes:

- Country Z’s headline tax rate is 20%. 15% withholding tax has been deducted from the interest. The dividend income is paid out of profit. The profit has been subject to tax in Country X.

- This compensation payment is for a breach of contract by AB co., due to the early termination of VKSS’s ten-year right to use the tradename in Singapore.

- In order to continue trading in Singapore, following the termination of the agreement with AB, VKSS entered into a new agreement with XY for the ten-year right to use its standard operating procedures in Singapore. XY is a resident of Country X.

- VKSS has complied with the Singapore withholding tax provisions in respect of any payments made to XY.

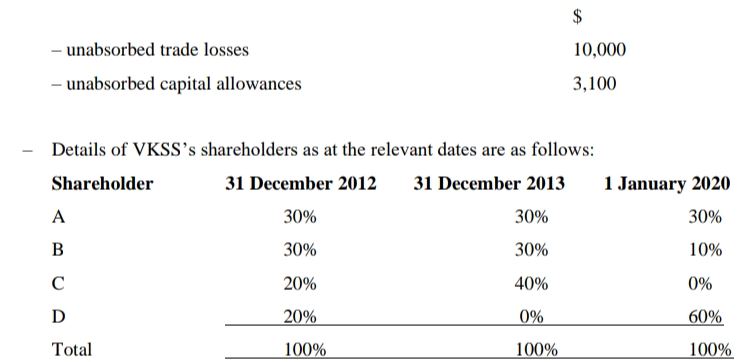

- VKSS has the following unabsorbed amounts brought forward from the year of assessment 2013:

Required:

(a) Compute the chargeable income (before partial tax exemption) of VKSS for the year of assessment 2020.

Note: You should start your computation with the net profit before tax of $800,000 and indicate by the use of zero (0) any profit or loss account item which does not require tax adjustment.

(b) Explain the corporate tax treatment of the compensation of $300,000 received from and the payment of $250,000 made to XY.

Note: You should ignore withholding tax implications.

QUESTION 2

Raju is the finance director of Brilliant Pte Ltd is a wholly-owned Singapore subsidiary of Intelligent Ltd which is listed in a stock exchange.

He derived the following employment income and benefits:

- A monthly salary of $30,000.

- A car with a chauffeur. The car was purchased by the company on 1 January 2019 for $500,000 and has a residual value of $120,000. All of the car’s petrol costs and maintenance costs are borne by the company which amounts to $8,500. The total remuneration of the chauffeur in 2019 was $36,000. The total mileage for 2019 was 30,000 km. 30% of the total mileage was for private use.

- He had been awarded a stock option for 5,000 shares in the parent company on 1 October 2014, when the stock price was $30 per share. On 30 June 2019, he met all the conditions of the award and exercised the option in full at the exercise price of $10 per share. 60% of the shares from the option can be sold immediately after the exercise but the remaining 40% can only be sold one year after the date of exercise. The stock price on 30 June 2019 was $50 per share.

- A fully paid holiday costing $10,000 for working for the past ten years.

- A gold ring costing $150 on his birthday.

- Reimbursement of his mandarin class tuition fee, totaling $3,600.

- An interest subsidy of $10,000. Raju obtained a loan from a bank to fund the purchase of his residential apartment. He incurred a total interest expense of $20,000 on this loan but in accordance with the company’s housing loan scheme can only claim a maximum of $10,000. The company’s housing loan scheme is available to all its employees and Raju is not a shareholder.

In addition to his employment income, Raju also derived the following incomes during the year 2019:

- Interest income of $5,000 from a loan he has extended to his friend, Tony. Tony used the loan to acquire a property in Singapore.

- Dividend income of $1,000 from an XYZ company.

Required:

Calculate Raju’ tax liability for the year of assessment 2020, if the personal tax relief of Thomas for the year is $25,000.

Note: You should indicate with the use of ‘0’ any item which is not taxable or not deductible.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

SECTION B

Question 3

Lum Pte Ltd is a GST registered trader. It owns an apartment that is leased to an expatriate couple. The lease agreement states that the monthly rental for the furnished apartment is $3,500. The annual value of the apartment according to the Valuation List is $36,000 for the year 2019.

Required

a) State the types of supplies made by Lum in respect of the lease agreement.

b) State the number of output goods and services tax (GST) chargeable by Lum on the monthly rental in the year 2019.

c) Determine how much is the input GST that Lum is entitled given the transactions below I assuming t is GST-registered. (All expenses are quoted without GST where applicable)

- $300 paid for the repair of the sink to the non-registered service provider

- $500 being interest paid on loan to purchase the apartment

- $1,500 being principal repayment on the same loan

- $800 being agency fees for securing tenant paid to a GOT-registered property agency

- $1,200 being the quarterly maintenance fees charged by the GST-registered property manager.

QUESTION 4

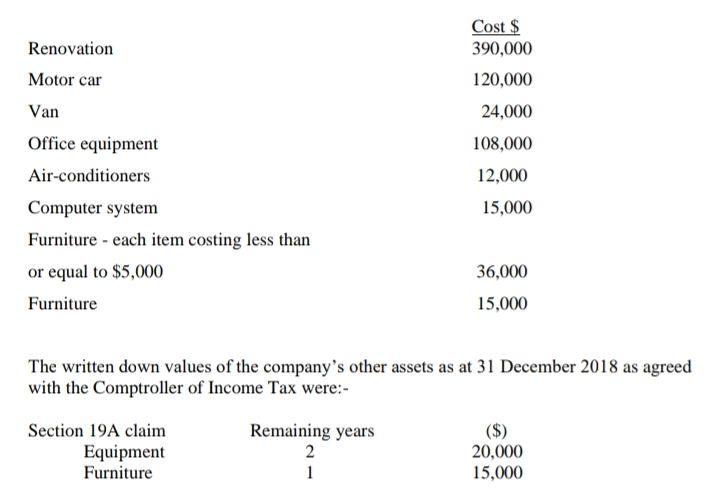

a) Dolly Ltd has been incorporated in Singapore since 2010. The company’s financial year-end is 31 December.

During the year 2019, the company renovated its premises and the following assets were acquired: –

Required

(a) Compute the maximum capital allowances claimable by Dolly for the Year of Assessment 2020, together with the written down values on 31 December 2018.

QUESTION 5

John is the new chief financial officer of DNP, a company incorporated and tax resident in Singapore. John has conducted a review of DNP’s tax filings for the year of assessment 2020 and discovered the following:

(i) All employees are entitled to a meal allowance for working overtime in addition to their fixed meal allowance. The fixed monthly meal allowance had been reported in the employees’ Form IR 8A but the meal allowance for ad hoc overtime was not reported.

(ii) DNP maintains a liaison office in India for the purpose of promoting the sales of its products in India. It has not claimed a tax deduction for the total operating cost of $100,000 incurred in maintaining this office.

(iii) It received branch profits repatriated from its Hong Kong branch. These profits have been taxed in Hong Kong at its profits tax rate of 16%. DNP has not included these profits in its Singapore tax computation.

(iv) It paid a contractor $8,000 to install a base to run the cables and trunking required for the installation of a computer system. Capital allowances have been claimed on the installation cost of $8,000.

(v) It donated $2,000 to an institution of public character (IPC) in return for the space to place a banner promoting new products at a charitable event organized by the IPC. The IPC usually charges its customers $1,500 for the use of such space. DNP has claimed a tax deduction of $5,000 (being 2.5 times $2,000) for this donation.

(vi) It paid a license fee of $5,000 to Arthur Ltd, a company incorporated and tax resident in Country A, for the use of its brand name in Singapore. There is no double taxation agreement between Singapore and Country A. DNP has not accounted for any Singapore withholding tax on the license payment.

Required:

(a) For items (i) to (iv), state, giving reasons, whether the actions taken by DNP are correct.

(b) For item (v), explain why the action taken by DNP is incorrect and quantify the amount of the actual tax deduction (if any) available.

(c) For item (vi), state, giving reasons, whether tax should have been withheld from the license fee payment and if so, the consequences for DNP of not doing so.

We offer taxation assignment help to SUSS university students at a very affordable price. We also provide you with the right solutions for every tax-related questions. Our income tax assignment writing services are very convenient for Singapore students.

Looking for Plagiarism free Answers for your college/ university Assignments.

- INDIVIDUAL RESEARCH PROJECT: MERGERS AND THEIR IMPACT

- PSS388 End of Course Assessment January Semester 2025 SUSS : Integrated Public Safety And Security Management

- PSY205 Tutor-Marked Assignment 02 SUSS January 2025 : Social Psychology

- Math255 S1 Assignment-2025 SUSS : Mathematics for Computing

- BUS100 Tutor-Marked Assignment January 2025 SUSS : Business Skills And Management

- CSCXXX SUSS : New System Development Using Java : Soft Dev Pte Ltd Project

- Cloud Computing: Fundamentals, Networking, and Advanced Concepts

- COS364 Tutor-Marked Assignment January 2025 Sem SUSS : Interventions for At-Risk Youth

- FMT309 Tutor-Marked Assignment 01 SUSS January 2025 : Building Diagnostics

- HBC203 Tutor-Marked Assignment 01 January 2025 SUSS : Statistics and Data Analysis for the Social and Behavioural Sciences