| University | University of London (UOL) |

| Subject | AC1025: Principles of Accounting |

Question 1

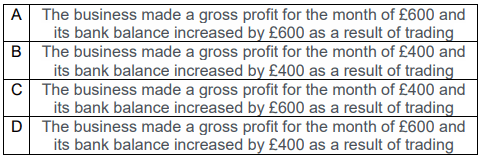

Adams plc buys and sells handbags for cash. It buys them for £20 each and sells them for £35 each. During April, its first month of trading, the company bought 50 handbags and had 10 handbags remaining in inventory at the month’s end.

Ignoring any other expenses or payments, which of the following statements is true for April?

Question 2

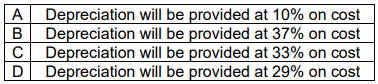

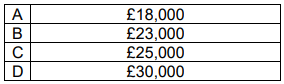

Jones plc bought a motor vehicle for £26,000. The vehicle has an estimated useful life of 3 years and an estimated residual value of £3,500.

If depreciation is to be provided on a straight-line basis, which of the following statements is true?

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 3

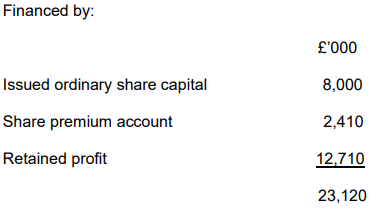

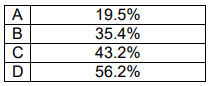

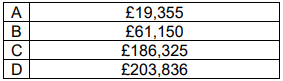

Howell Ltd made an operating profit of £4,500,000 for the year ended 31 December 2021. An extract from the company’s statement of financial position as of 31 December 2021, was as follows:

The company has no long-term loans. The return on capital employed for the year ended 31 December 2021 was:

Question 4

A company has a gross profit ratio of 30%. The trade receivables collection period for the company has been calculated at 62 days. If the actual gross profit earned was £360,000, what were the trade receivables?

Question 5

The cost of the inventory items of Robertson Ltd at the end of the year 2021 corresponds to £25,000. The selling price is £30,000 but the costs related to the selling and delivery of the inventory items are £7,000. The value of the inventory at the end of the year 2021 is:

Buy Custom Answer of This Assessment & Raise Your Grades

Question 6

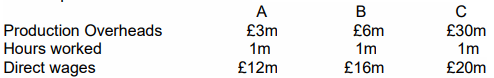

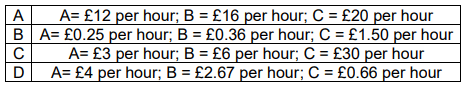

The manufacturing plant at Daydream plc has three departments. The budgets for each department is shown below:

Calculate the production overhead for each department.

Question 7

Bates Ltd makes and sells 200,000 gadgets for children a year for £15 each. Fixed costs are £360,000 a year and variable costs are £12 per unit.

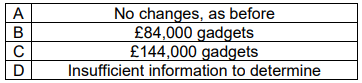

If Bates Ltd can increase the volume of sales to 250,000 gadgets by reducing its selling price to £14.50. What is the breakeven by volume?

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Struggling with your AC1025 Principles of Accounting assignment? Don't stress out! Singapore Assignment Help is here to lend you a helping hand. Our qualified professionals have in-depth knowledge of accounting principles and can provide comprehensive assistance to ensure your assignment stands out. Whether it's preparing financial statements or analyzing business transactions, we are committed to helping you with your Principles of Accounting & Finance assignment at low price.

Looking for Plagiarism free Answers for your college/ university Assignments.

- CSCI312 Assignment 2: Conceptual Modelling and Implementation of a Data Warehouse and Hive Queries

- CH2123 Assignnment : Fugacity, VLE Modeling & Henry’s Law Applications

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- PSB501EN Assignment 1: Engineering Systems Integration: A Multi-Technique Approach to Mechanical Analysis

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Cinematic Dissection: Stylistic Elements and Their Thematic Significance

- Assignment: Transforming Talent in the AI Era: From War to Wealth through Ecosystem Innovation

- COMP 1105 Assignment: Health-Focused E-Commerce Website: A Web Technologies Project Using HTML5, CSS, and JavaScript

- Assignment: Machine Learning in Robo-Advisory Services: Evolution, Applications, and Future Trends

- OMGT2229 Assignment: Quantitative Forecasting, Economic Order Analysis, and Strategic Sourcing Decision-Making for JB Hi-Fi