| University | Singapore University of Social Science (SUSS) |

| Subject | FIN203: Essentials of Financial Management |

Question 1

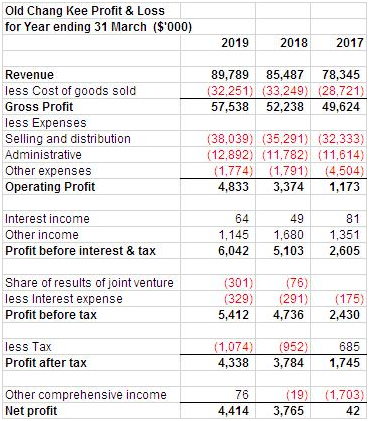

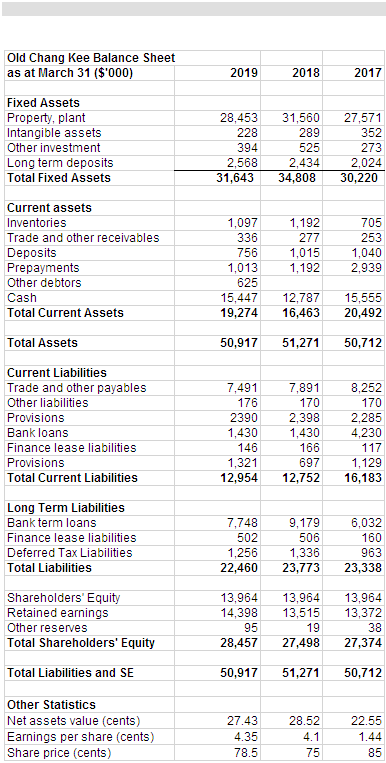

The financial statements of Old Chang Kee Pte Ltd are given below:

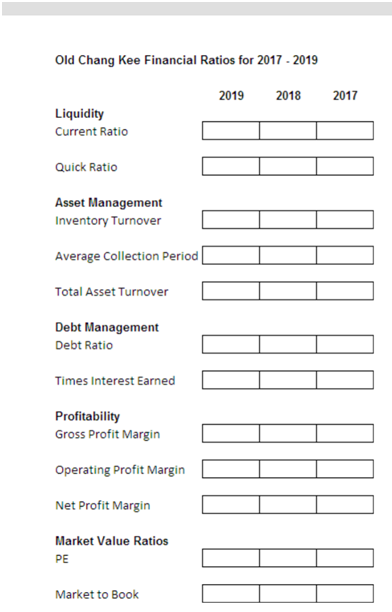

1. Based on the financial statements above compute the ratios as given in the answer template below. Use a 360-day year. Answers for all ratios to be given to two (2) decimal places, except for the profitability ratios which are to be shown as percentages to one (1) decimal place.

2. Answer the following questions regarding the analysis of Old Chang Kee’s financial statements:

- Interpret Old Chang Kee’s liquidity and discuss whether it has any difficulty paying its creditors.

- Which ratios computed in part (a) suggest that the inventory level is relatively low. Briefly discuss why this is so.

- An analyst computed the expected earnings of the company to be $0.05. Based only on the PE ratios you have computed and the financial data are given in the question, what would be a reasonable value of each share? Examine and explain.

- Discuss why Old Chang Kee’s stock price is very much higher than its net asset value.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 2

Answer the following questions regarding the goal of finance and agency.

- The goal of finance is to maximise shareholders’ wealth. A company is already meeting the government standards of safety and health at the workplace. Suppose the company spends money to upgrade the cafeteria as well as provide some recreational facilities for its workers. Discuss whether this means that the management of the company is not maximising shareholder wealth.

- The CEO of the company is an agent of the shareholders (the principal). Appraise the claim that since the CEO of a company owns 55% of the shares of a company there is no agency problem.

Question 3

John is looking at several options to fund his son’s 4-year university degree.

The university fees of $45,000 a year will have to be paid to start 11 years from today. He is analysing an insurance plan that pays out $45,000 a year for 4 years with the first payout 11 years from today. The insurance plan has several payment options:

Option 1

Pay $60,000 today.

Option 2

Beginning 1 year from today, pay $12,000 a year for the next 8 years.

Option 3

Beginning 1 year from today, make payments each year for the next 8 years. The first payment is $11,000 and the amount increases by 5% each year.

Answer the following questions regarding the options above:

- Calculate the present value of each option. Use a 10% discount rate.

- Analyze which option John should choose.

- If the discount rate is not given to you, what would be an appropriate discount rate to use?

We offer quality finance assignment help to learners. Our online homework helpers who offer Essentials of Financial Management (FIN203) Assignment help, understand the financial management fundamentals and concepts very well. So students can clear their concepts and theories of financial management with our support.

Looking for Plagiarism free Answers for your college/ university Assignments.

- Liam’s Employment Status & Contractual Obligations at Eclipse Marketing : SUSS

- PSB6014CL Individual Written Report Coventry University January 2025 : Project Management

- BUS352 Group-based Assignment January 2025 Semester SUSS :Operations Analytics

- BUS356 Group-based Assignment January 2025 Semester : Business Negotiation

- TZU CHI SCHOOL Term 3 Argumentative Essay Assessment 2024-25 : Historical Accuracy of ‘The Boy in the Striped Pajamas’

- PSB6012CL Course Work :Business Research Methods Key Approaches and Applications

- Article : Cell Biology and Molecular Regulation Rb–E2F Activity and Proliferation Commitment

- Workplace Law Assignment: Employment Status and Contractual Obligations

- Management Foundation Studies: Individual Assignment 2 Accounting & Business Finance SIM Global Education

- HRM335 Tutor-Marked Assignment (TMA01) January 2025 SUSS : Leadership Development