| University | National University of Singapore (NUS) |

| Subject | Investment Portfolio Management |

Assignment Questions:

1. Download the most recent 5-years of monthly stock price history for two large market capitalisation stocks from Yahoo Finance (click the Investing tab followed by the Historical Prices tab). Create a time series of monthly returns from this time series of monthly stock prices. Calculate the annualised mean return, standard deviation, and correlation of the stocks.

2. Use investment proportions for the two stocks ranging from zero to 100% using intervals of 10%. Tabulate and draw the investment opportunity set of the two stocks.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

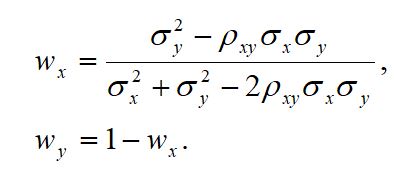

3. Calculate the weights on the minimum variance portfolio consisting of the two stocks, which we denote by stock X and stock Y, using the following formulae

4. Calculate the expected return and standard deviation of this minimum variance portfolio. Plot the two assets and the minimum variance portfolio on a diagram and plot the efficient frontier consisting of portfolios made up of these two assets.

5. Discuss diversification referring to the expected return and standard deviation of the minimum-variance portfolio in your answer.

6. Write 2,500 words (+-10%) word report. Include in your report an introduction, a method section, a results section, and conclusions.

Hire finance assignment expert to receive premium quality Investment Portfolio Management assignment help services in Singapore. We provide 24*7 free professional guidance for writing complex Investing & Portfolio management assignments on the given timeline. You can always rely on us to get a portfolio management assessment answer.

Looking for Plagiarism free Answers for your college/ university Assignments.

- INDIVIDUAL RESEARCH PROJECT: MERGERS AND THEIR IMPACT

- PSS388 End of Course Assessment January Semester 2025 SUSS : Integrated Public Safety And Security Management

- PSY205 Tutor-Marked Assignment 02 SUSS January 2025 : Social Psychology

- Math255 S1 Assignment-2025 SUSS : Mathematics for Computing

- BUS100 Tutor-Marked Assignment January 2025 SUSS : Business Skills And Management

- CSCXXX SUSS : New System Development Using Java : Soft Dev Pte Ltd Project

- Cloud Computing: Fundamentals, Networking, and Advanced Concepts

- COS364 Tutor-Marked Assignment January 2025 Sem SUSS : Interventions for At-Risk Youth

- FMT309 Tutor-Marked Assignment 01 SUSS January 2025 : Building Diagnostics

- HBC203 Tutor-Marked Assignment 01 January 2025 SUSS : Statistics and Data Analysis for the Social and Behavioural Sciences