| University | Temasek Polytechnic (TP) |

| Subject | Business Accounting |

Learning Objectives

At the end of the lecture, you should be able to:

- explain the importance of periodic profit determination.

- explain the accounting period concept and matching principle in relation to profit determination.

- prepare the profit and loss statement and balance sheet of a service firm.

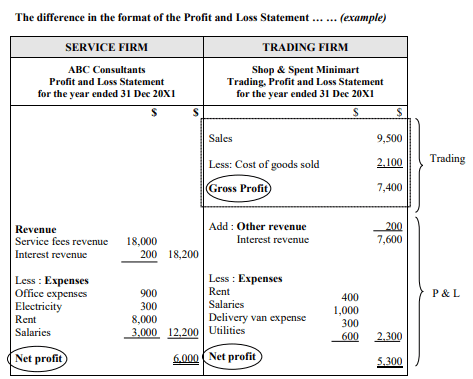

- distinguish between the profit and loss statement of a trading firm and that of a service firm.

- prepare journal entries to close the accounts at the end of the accounting period.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Importance of Periodic Profit Determination

- The primary aim of businesses is to make profits (though they can incur losses instead). The calculation of such profits and losses is an important objective of the accounting function.

- Why is there a need for periodic profit determination?

- Indication of efficiency of enterprise

- Determination of profits available for distribution to owners

- Guide to decision-making

∗ Management (planning & control)

∗ Owners (investment plans) - Satisfy legal requirements (taxation, Companies Act)

2. Accounting Concepts Underlying Profit Determination

When is revenue generally recognized?

When the earning process of the revenue is completed (cash may or may not be received).

For a manufacturing firm, when is revenue recognized?

- Receive an order

- Purchase raw materials to produce the order

- Manufacture the product

- Deliver the product

- Receive cash

How do you decide on the applicable accounting period for expenses?

Necessary to relate the expenses back to the revenue they helped earn. Once it is decided to recognize revenue in a certain period, the expenses incurred in order to earn that revenue must be recognized regardless of when they are paid.

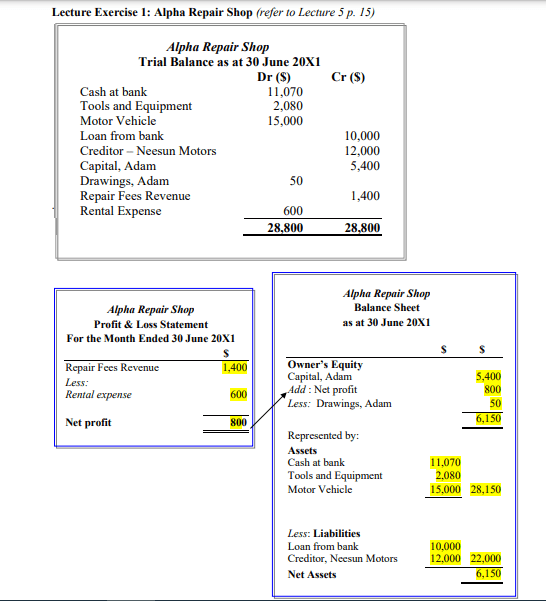

3. Profit and Loss Statement and Balance Sheet of Service Firm

Classify trial balance items into:

Profit & Loss Statement/Income Statement – Revenue and Expense

Balance Sheet – Owners’ Equity, Assets, Liabilities

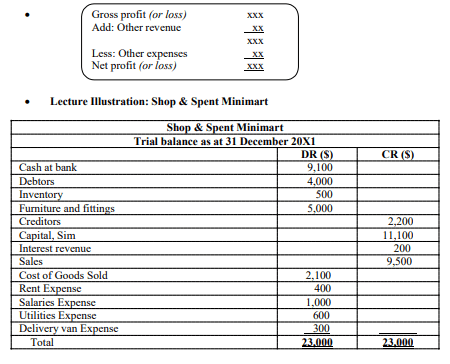

4. Profit and Loss Statement and Balance Sheet of TRADING firm

- Trading firms (also called merchandising firms) are mainly concerned with buying and selling merchandise goods, also known as stocks or inventory.

- The purpose of preparing the Profit and Loss (P&L) Statement is to show how much net profit (or loss) has been made by the business firm during a period. Refer to Warren, p. 19.

- Includes the results from trading (i.e. gross profit or loss), other revenue, and other expense of the business operations.

The revenues and expenses of trading firms are summarised and then reported in the following:

- Trading Statement

- Profit and Loss Statement

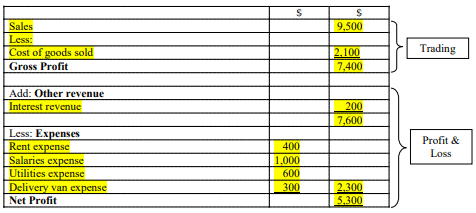

Shop & Spent Minimart

Trading, Profit, and Loss Statement for the year ended 31 December 20X1

Glossary

Sales

- Revenue earned from performing the trade (e.g. selling the goods)

Sales Return

- Merchandise/Stocks that were returned to the seller by a customer. This account is a contra sales account.

Cost of Goods Sold (COGS)

- Cost of inventories purchased include:

– the purchase price of goods bought from a supplier

– any other costs incurred in bringing the goods into the location/condition ready for sale. (e.g. freight inwards, customs duty, etc)

- When the inventories are sold, this cost of inventories becomes cost of

inventories sold i.e. Cost of Goods Sold (COGS)

Gross profit

- The profit derived from the sale of goods (i.e. trading activities) alone,

before considering other revenue and expenses - For a definition, refer to Warren, p. 192.

Gross profit = Sales – Cost of goods sold

Net profit: Profit derived from business’s revenue after subtracting all operating and interest expenses

Net profit = Gross profit + Other revenue – business expenses

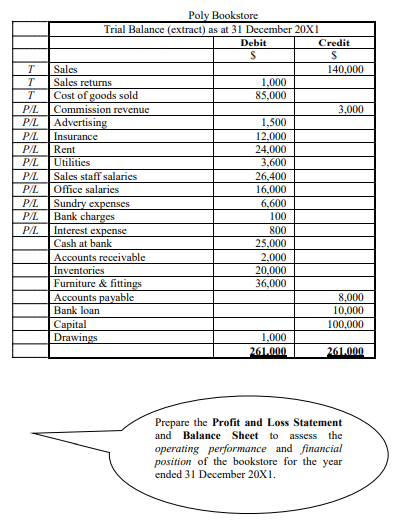

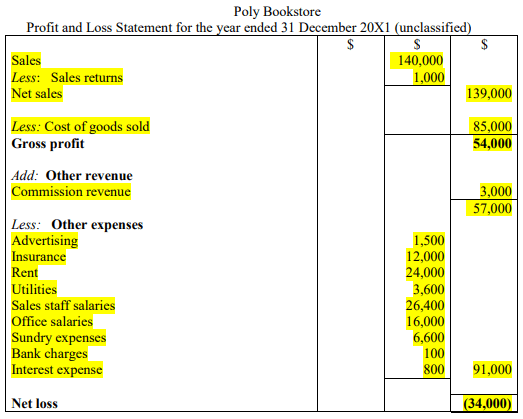

Lecture Exercise 2: Poly Book Store

Poly Book Store operates in one of the polytechnics in Singapore. It sells textbooks, books, stationery, and snacks. It started with a capital contribution of $160,000. It generated $70,000 sales but incurred a loss of $60,000 in its first year of operations. The trial balance as of 31 December 20X1 is attached below.

How would you assess the performance of Poly Bookstore?

In its second year of operations, it is still incurring a loss.

Revenues are not sufficient to cover its operating expenses.

However, the net loss has declined from $60,000 to $34,000.

The business would need to generate more revenues in order to make a profit.

Self-Study

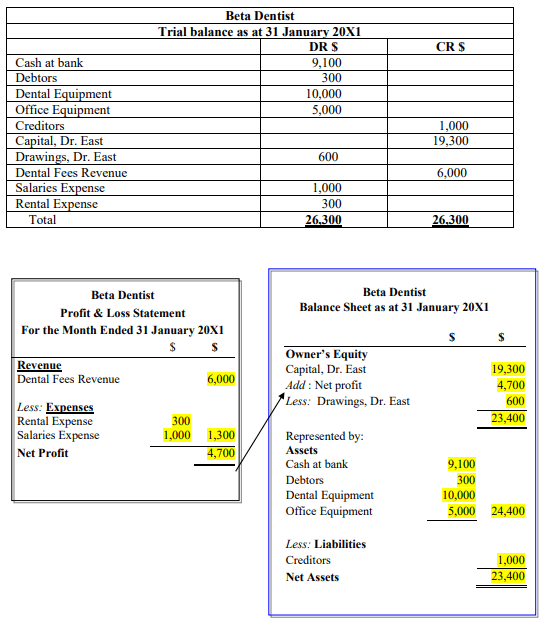

Lecture Exercise 3: Beta Dentist

Extract the balances from the ledger a/cs in Lecture 5

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Avail the excellent homework help to get top-notch grades in your business accounting assignment. At Singapore Assignment Help we have a team of dedicated account experts who have the amazing capability to sort out all problems related to accounting assignment at a very low price.

Looking for Plagiarism free Answers for your college/ university Assignments.

- CH2123 Assignnment : Fugacity, VLE Modeling & Henry’s Law Applications

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- PSB501EN Assignment 1: Engineering Systems Integration: A Multi-Technique Approach to Mechanical Analysis

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Cinematic Dissection: Stylistic Elements and Their Thematic Significance

- Assignment: Transforming Talent in the AI Era: From War to Wealth through Ecosystem Innovation

- COMP 1105 Assignment: Health-Focused E-Commerce Website: A Web Technologies Project Using HTML5, CSS, and JavaScript

- Assignment: Machine Learning in Robo-Advisory Services: Evolution, Applications, and Future Trends

- OMGT2229 Assignment: Quantitative Forecasting, Economic Order Analysis, and Strategic Sourcing Decision-Making for JB Hi-Fi

- Assignment 2: Corporate Finance and Planning: An In-Depth Financial Analysis of Company