| University | Singapore University of Social Science (SUSS) |

| Subject | FIN203: Essentials of Financial Management |

Question 1

You are working as an equity analyst of a local brokerage firm. Your boss asks you to do some research regarding the historical risk and return of two stocks, namely Mapletree Commercial Trust (Mapletree) and DBS Group Holdings Ltd (DBS).

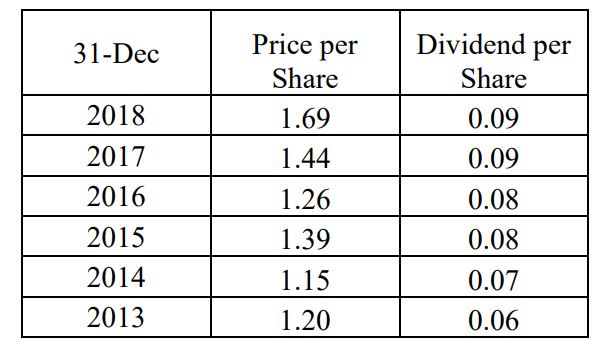

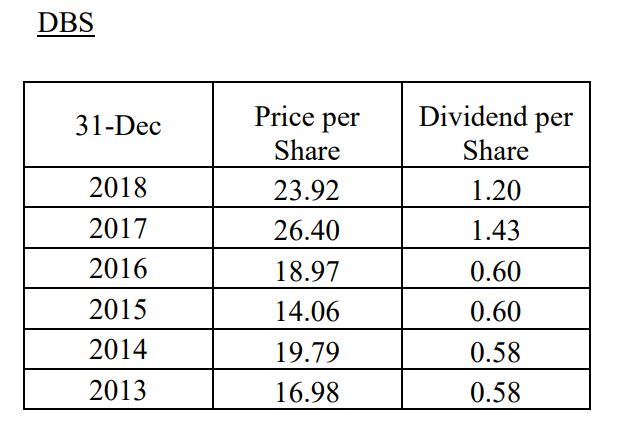

The year-end share price and dividend data for both stocks are detailed below:

Mapletree

Draft an email to your boss covering the following aspects:

(a) Solve the annual total return over each of the 5 years (i.e. from 2014 to 2018) for both stocks. Make sure that you differentiate between two components (capital gain and dividend yield) when solving for total return.

(b) Solve the annual variance and standard deviation over each of the 5 years (i.e. from 2014 to 2018) for both stocks.

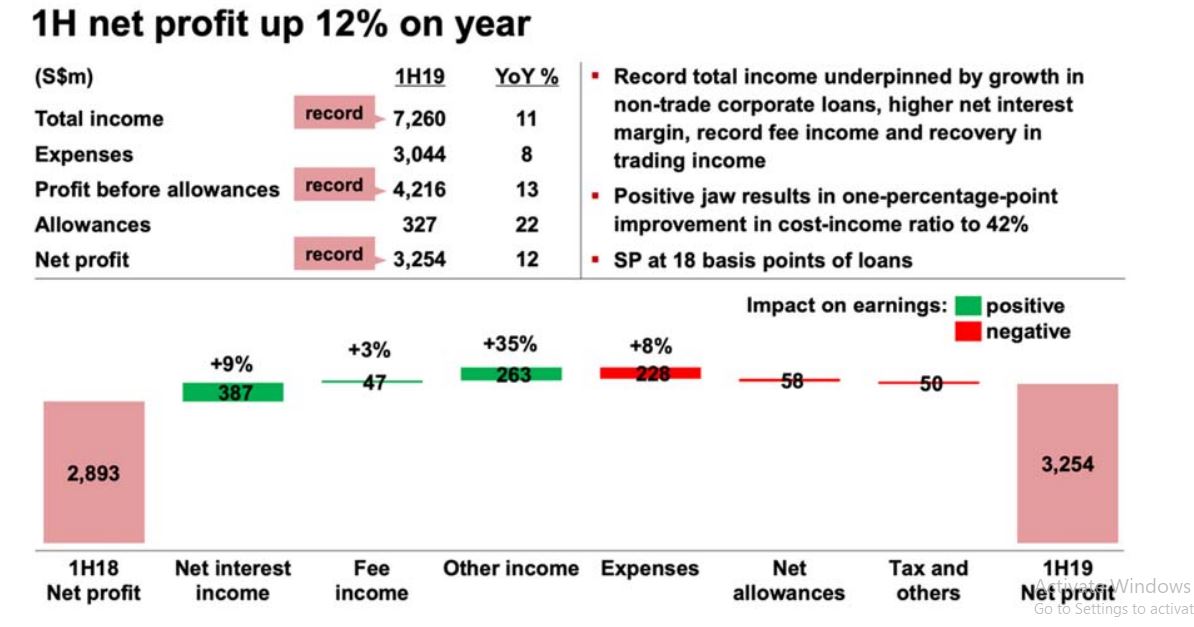

(c) An extract of an announcement made by DBS on 29 July 2019 (at the close of business day) relating to the first half 2019 financial results is appended below:

Below is a chart of DBS share price between 22 July 2019 and 2 September 2019:

Source: Thomson Reuters

Hypothesize the form of market efficiency based on the information given relating to DBS.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 2

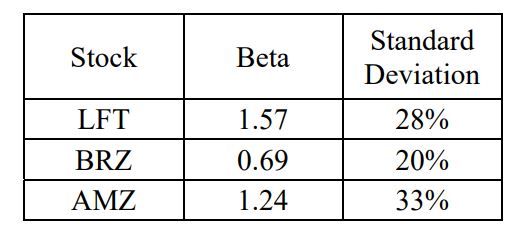

You have been entrusted with $500,000 to invest. The following information relating to three stocks have been given to you:

The average returns of long-term corporate bonds and long-term government bonds are 5% and 3%, respectively. The market risk premium is 6% and the country risk premium is 2%.

(a) Construct a portfolio that has a beta equal to the market and at least $50,000 must be invested in each stock.

(b) Examine whether LFT or AMZ is riskier.

(c) Solve the expected return for all three (3) stocks.

Question 3

When researching which corporate bonds to invest, you noted that some bonds were trading at a premium (e.g. 4.7% coupon bonds issued by BSD Ltd was trading at 5% above its par value), whereas some were trading at a discount (e.g. 5.25% coupon bonds issued by API Ltd was trading 2% below its par value).

(a) Hypothesize four (4) reasons for your observations.

(b) Market data obtained from S&P Capital IQ is shown below:

- VMX Ltd has a beta of 1.3 and a debt-to-equity ratio of 0.5

- The yield on long-term Singapore government bonds = 3%

- Yield on AAA-rated corporate bonds = 5%

- Bond price issued by VMX Ltd = $1,150 (6% coupon, paid semiannually, expiring in 8 years)

- Inflation rate = 1%

- Market risk premium = 6%

- The corporate tax rate is 17%.

Solve for VMX’s weighted average cost of capital.

(c) VMX stock is currently trading at $25.80. Its most recently reported earnings per share were $1.20. Based on guidance provided by management at the recent investor’s conference, earnings are expected to grow at 20% per year for the next 3 years, and 3% thereafter. The estimated dividend pay-out ratio is 50% for the next 3 years and 75% thereafter. Verify whether VMX stock is correctly priced by the market.

(d) The market value of EEL Ltd’s equity is $50 million and it has $5 million debt. Management intends to issue bonds $20 million worth of bonds and use the proceeds to repurchase some outstanding shares. Examine whether the value of EEL’s equity will increase or decrease under the following scenarios:

(i) no corporate tax and no bankruptcy costs,

(ii) corporate tax rate is 17% and no bankruptcy costs and

(iii) corporate tax rate is 17% and with bankruptcy costs.

If you have any trouble in paying someone to do your assignment then don't worry. We, at Singapore Assignment Help, have a very easy process of assignment order and have a secure payment gateway for SUSS university students. So take help with us for FIN203: Essentials of Financial Management Assignment and get your desired goal.

Looking for Plagiarism free Answers for your college/ university Assignments.

- INDIVIDUAL RESEARCH PROJECT: MERGERS AND THEIR IMPACT

- PSS388 End of Course Assessment January Semester 2025 SUSS : Integrated Public Safety And Security Management

- PSY205 Tutor-Marked Assignment 02 SUSS January 2025 : Social Psychology

- Math255 S1 Assignment-2025 SUSS : Mathematics for Computing

- BUS100 Tutor-Marked Assignment January 2025 SUSS : Business Skills And Management

- CSCXXX SUSS : New System Development Using Java : Soft Dev Pte Ltd Project

- Cloud Computing: Fundamentals, Networking, and Advanced Concepts

- COS364 Tutor-Marked Assignment January 2025 Sem SUSS : Interventions for At-Risk Youth

- FMT309 Tutor-Marked Assignment 01 SUSS January 2025 : Building Diagnostics

- HBC203 Tutor-Marked Assignment 01 January 2025 SUSS : Statistics and Data Analysis for the Social and Behavioural Sciences