| University | University of London (UOL) |

| Subject | FN2190: Asset Pricing and Financial Markets |

Aims and objectives

The aims of this course are to:

• Provide students with a thorough grounding in asset pricing

• Develop students’ skills in applying pricing methods to realistic scenarios.

• Provide a critical overview of the research on financial market efficiency.

• Allow students to develop an understanding of how securities markets operate.

Learning outcomes

At the end of the course and having completed the essential reading and activities students should be able to:

• Describe the important differences between the stock, bond, and derivative securities.

• Explain how to price assets using both present value and absence of arbitrage methods.

Syllabus

Present value calculations; discounting, compounding and the Net Present Value rule; quoted versus effective interest rates; annuities and perpetuities; Fisher separation.

Bond valuation: valuing coupon, and zero-coupon, bonds via present value methods; the term structure of interest rates and bond valuation; yield to maturity; interest rate risk and Macaulay duration; spot and forward interest rates; modeling the term structure of interest rates.

Stock valuation: dividend discount models; the Gordon Growth model; earnings, payout ratios, and stock prices; company valuation and the Present Value of Growth Opportunities.

Portfolio Theory and the Capital Asset Pricing Model: investor preferences; the mathematics of security portfolios; investor portfolio selection; market equilibrium and the CAPM; empirical evaluation of the CAPM and competing models.

Efficient security markets: defining informational efficiency; why should markets be efficient?; problems with testing efficiency; evidence on the efficiency of stock markets; puzzles and anomalies.

Derivative pricing: the definition of a derivative contract; how to price derivatives using the absence of arbitrage; forwards and futures contracts; pricing forwards on stocks, currencies, and commodities; option contracts; practical uses of options contracts; bounds on option premia; option pricing via binomial models and Black-Scholes

Question 1

You observe that the current three-year discount factor for default-risk-free cash flows is 0.68. Remember, the t-year discount factor is the present value of $1 paid at time t, i.e. 𝑑𝑑𝑡𝑡 = (1 + 𝑟𝑟𝑡𝑡)−𝑡𝑡, where 𝑟𝑟𝑡𝑡 is the t-year spot interest rate (annual compounding). Assume all bonds have a face value of $100 and that all securities are default-risk free. All cash flows occur at the end of the year to which they relate.

a) What is the price of a zero-coupon bond maturing in exactly 3 years?

b) Your friend makes the following observation about the above bond: “Since there is no risk of default and there are no coupons to re-invest, buying the 3-year zero-coupon bond today is a risk-free investment; that is, you are guaranteed to earn an annual return of 13.72% (i.e. 3-year spot rate)”. Explain why your friend is not entirely correct and how you would modify the statement to make it correct.

c) In addition to the bond in (a), you observe the following: a 2-year coupon bond paying 10% annual coupons with a market price of $97, and two annuities that are trading at the same market price as each other. The first annuity matures in 3 years and pays annual cash flows of $20, while the second annuity pays annual cash flows of $28 and matures in 2 years. Using this information:

i. Complete the term structure of interest rates, i.e. determine the one- and two-year discount factors, d1 and d2, respectively.

ii. Determine the price of the annuities.

d) Assuming annual compounding, determine the implied one-period forward rates 𝑓𝑓2 (i.e. between year 1 and 2) and 𝑓𝑓3 (i.e. between year 2 and 3) in this economy. What inference can you make about the market’s estimate of the one-year spot interest rate at 𝑡𝑡 = 1 if the liquidity preference theory is correct?

e) Suppose you decide to purchase a 1-year zero-coupon bond today and also contract today to re-invest the proceeds from the bond for the following two years at 16.5% per year. Show that this arrangement presents an arbitrage opportunity. Demonstrate how you would take advantage of this opportunity.

f) Consider discount factors such that d1 < d2 < d3. Explain why it would be odd to observe such a situation in a competitive market.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 2

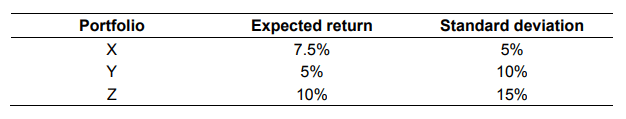

Assume the CAPM holds. Consider three feasible portfolios of stocks X, Y and Z with the following return characteristics:

a) Explain why the beta is the appropriate measure of risk in this world. (5 marks)

b) Portfolio Y is known to be uncorrelated with the market. Explain why this property implies that the risk-free rate in the economy is 5%. (5 marks)

c) It is known that one of the portfolios X, Y, Z lies on the efficient frontier (which includes the risk-free asset). Which portfolio is efficient? Explain/justify your answer.

d) An investment manager approaches you and offers you an investment product with a claimed expected return of 12% and a standard deviation of 20%. Should you accept this investment? Why/why not? If not, show how the manager can optimally create a portfolio with identical return volatility to his proposed portfolio but with a superior expected return. Illustrate your answer graphically, making sure to label all relevant elements of your picture.

e) Consider an investor who invests $50,000 in a portfolio consisting of X and Z. $10,000 of that investment was funded with risk-free borrowing. The expected return of the investor’s portfolio is 9.375%.

i. Calculate the dollar amounts invested in each of X and Z. (4 marks)

ii. If the correlation between X and Z is 2/3, what is the standard deviation of the investor’s portfolio?

f) Show that any portfolio on the Capital Market Line (CML) with a positive weight in the market portfolio is perfectly correlated with the market portfolio. Interpret this result.

Question 3

Assume all options are European, and that the underlying asset is a non-dividend-paying stock unless otherwise specified.

(a) A ‘protective put’ strategy involves buying both a put option on a stock and the underlying stock itself.

i. Draw a payoff diagram (not a profit-and-loss diagram) for a protective put strategy. Make sure to label all relevant parts of the diagram. Why do you think this strategy has its name?

ii. Using put-call parity, explain why the payoff of a protective put resembles the shape of the payoff of a call option.

(b) You observe two call options, A and B, with the same exercise price, written on the same underlying asset. Option A matures in one year, while B matures in 18 months. Which option has the higher value? Explain.

(c) The value of a European put option must satisfy the following restriction: 𝑝𝑝0 ≥ 𝑋𝑋𝑒𝑒−𝑟𝑟𝑟𝑟 − 𝑆𝑆0 where 𝑝𝑝0 is the current put price, 𝑆𝑆0 is the current price of the underlying stock, 𝑋𝑋 is the exercise price, 𝑟𝑟 > 0 is the annualized continuously compounded risk-free rate, and 𝑇𝑇 is the time till expiration. Prove by contradiction that the above arbitrage restriction must hold, i.e. show that if the condition does not hold, there is an arbitrage opportunity.

(d) It is also known that the value of a European put cannot be greater than the present value of its exercise price, i.e. 𝑝𝑝0 ≤ 𝑋𝑋𝑒𝑒−𝑟𝑟𝑟𝑟. This restriction, along with the one in (c), suggests that the price of a European put can fall below its exercise value prior to maturity. When is this situation likely to arise? Give an intuitive explanation as to why its value is below its exercise value in such circumstances.

(e) Stock K currently sells for $120. After one year, its price will either increase by 10% or fall by 10%. The annual risk-free interest rate is 5%.

i. Calculate the current value of an at-the-money European call option on stock K maturing in one year.

ii. Now assume that the volatility of Stock K increases so that if the stock price increases, it will still increase by 10% but if it falls, it will fall by more than 10%. Everything else including the expiration date, current stock price, exercise price, and interest rate stays the same. Show

Question 4

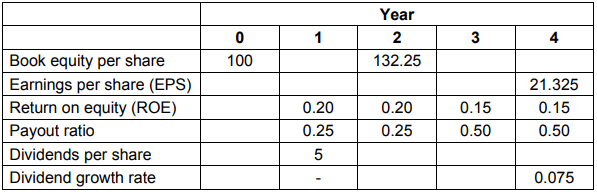

(a) The table below lists some partial information about a firm. Assume that the number of shares outstanding stays constant forever.

i. Fill in the missing values in the table from years 1 to 4.

ii. Assume that after year 4, the company maintains its ROE and payout ratio at year 4 levels. The cost of capital is 12.5%. What is the fair price of the company’s stock today (i.e. at t = 0)?

iii. Suppose the company announces today that it expects any new investments made in or subsequent to year 4 to only earn the cost of capital. The values you calculated in part (i) will be unaffected by this announcement. By how much will the share price change today after the announcement?

(b) Consider the following statement: “For markets to be informationally efficient, all investors must be rational”. Is this statement true? Why/why not? (you will be marked on the justification(s) provided).

(c) Companies sometimes try to match the duration of their assets and liabilities. Explain how you think this approach may be useful in protecting net worth from interest rate risk (net worth = A – L, the difference between the market value of assets and liabilities). When is this approach likely to prove less effective? Why?

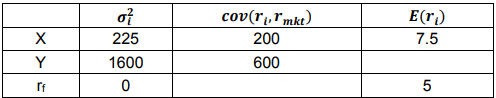

(d) Assume that the CAPM holds. Consider two firms X and Y, and the risk-free asset, with the following return characteristics:

What is the expected return of stock Y?

(e) Exactly one year ago, you entered into a forward agreement to purchase one unit of a commodity for $F in exactly T years from now. The current price of the commodity in the spot market is $S. The risk-free continuously

compounded interest rate in the market is currently r per year. There are no convenience yields or storage costs associated with holding the commodity. Using a replicating portfolio approach, show that the current value of your

forward agreement, f, is: 𝑓𝑓 = 𝑆𝑆 − 𝐹𝐹𝑒𝑒−𝑟𝑟𝑟𝑟

Buy Custom Answer of This Assessment & Raise Your Grades

Thinking to pay money for homework on (FN2190) Asset Pricing and Financial Markets? We have the best solution for you! At Singapore Assignment Help you will get the best urgent Assignment Help that you will not find anywhere else as we provide especially skilled finance writers who serve authentic solutions on asset management assignment for you at a cost-effective price. So hurry up and get an outstanding rank in your every assignment.

Looking for Plagiarism free Answers for your college/ university Assignments.

- HRM331: Talent Management – Strategic Shift from the War for Talent to the Wealth of Talent

- Marginalised Populations – The Structural and Cultural Exclusion of People Experiencing Homelessness in Singapore

- CVEN3501 Assignment 2: Groundwater Modelling of Drawdown from a Pumping Bore

- CSCI312 Assignment 2: Conceptual Modelling and Implementation of a Data Warehouse and Hive Queries

- CH2123 Assignnment : Fugacity, VLE Modeling & Henry’s Law Applications

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- PSB501EN Assignment 1: Engineering Systems Integration: A Multi-Technique Approach to Mechanical Analysis

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Cinematic Dissection: Stylistic Elements and Their Thematic Significance

- Assignment: Transforming Talent in the AI Era: From War to Wealth through Ecosystem Innovation