| University | Nanyang Polytechnic (NYP) |

| Subject | Banking & Finance |

QUESTION 1

Using regression analysis on historical loan losses, a bank has estimated the following:

where equals the loss rate in the commercial sector and equals the loss rate in the retail sector and equals loss rate for its total loan portfolio.

Based on the regression analysis alone what sector should the bank limit its loans?

Reconcile the existence of both retail and commercial loans

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

QUESTION 2

Discuss the kinds of coordination problems that can arise in loan workouts and how they can be resolved.

QUESTION 3

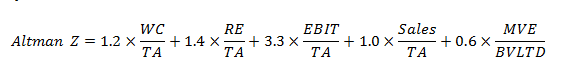

In Question 1, we discussed Altman Z that measures a firm’s creditworthiness

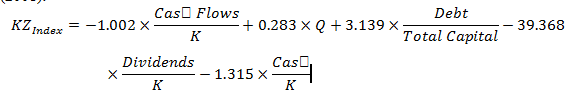

An index that measures the ability to obtain external financing is the KZ Index. The KZ-Index (Kaplan-Zingales Index) is a relative measurement of reliance on external financing. Companies with a higher KZ-Index score are more likely to experience difficulties when financial conditions tighten since they may have difficulty financing their ongoing operations.

The KZ-Index (Kaplan-Zingales Index) is described in Lamont, Polk and Saa-Requejo (2001):

Where:

Cash Flows = (Income Before Extraordinary Items + Total Depreciation and Amortizationt), K = Property, Plant and Equipment-1, Q = (Market Capitalization + Total Shareholder’s Equity – Book Value of Common Equity– Deferred Tax Assets) / Total Shareholder’s Equity, Debt = Total Long Term Debt + Notes Payable + Current Portion of Long Term Debt ,Dividends = Total Cash Dividends Paid (common and preferred) and Cash = Cash and Short-Term Investments. The ratio has been slightly modified by reducing the number of decimal places.

Your bank manager has asked you if it is possible to combine Altman Z and KZ index to permit improved decisions on whether a firm should have their loans approved (or rejected). You have created the figure below.

QUESTION 4 a

The Bank of Tinytown has two loans that have the following characteristics. If the covariance between A and B is0.0035, what are the expected return and standard deviation of this portfolio? Given the covariance, can the calculation be simplified? What will the risk of the portfolio be, given the simplification?

| Loan Size ($ million) | Return (%) | Variance (%) | |

| Loan A | $ 600.0 | 5.0 | 5.0 |

| Loan B | $ 1,200.0 | 8.0 | 7.5 |

QUESTION 4b

Briefly describe any way(s) that the risk of this portfolio may be reduced? Be specific.

Buy Custom Answer of This Assessment & Raise Your Grades

QUESTION 5a

You are evaluating a loan request of $3.5 million from Precise Corp and the bank will require an expected return of 4.0 percent per annum. The firm has an existing debt repayment obligation of $4.5 million. It has $2.0 million in equity. The firm has two projects, A and B. An investment in A will yield a payoff of $5.5 million with a probability of 0.8 and $3.0 million with a probability of 0.2. An investment in B will yield a payoff of $8.0 million with a probability of 0.4 and $0.5 million with a probability of 0.6. The firm has assets-in-place that generates $5.0 million with a probability of 0.75 and $1.0 million with a probability of 0.25. Assume that the distributions of payoffs for A and B are common knowledge, and the payoff from A is statistically independent of the payoff for B. However, as a bank officer, you cannot observe the firm’s project choice.

What rate should the bank charge in order to break even? Given this rate will a Nash equilibrium result?

QUESTION 5b

On presenting your results to the chief credit officer she asks if you have considered the analyst’s report that states that the firm is considering paying a dividend equal $2.0 million immediately. Will your recommendation change? Show calculations.

QUESTION 5c

What are alternatives that are available to approve the loan given your answer to Question 5b? Be specific and concise. No calculations are required.

QUESTION 6a

Consider a firm managed by an entrepreneur. The firm has two kinds of debt outstanding: senior debt under which it owes $750 to bondholders, and a subordinated bank loan that requires repayment of $2,550. The firm’s assets have a current liquidation value of $1,670 but if the firm continues to operate, it will be worth $2,750 with a probability 0.7 and $100 with a probability 0.3 one period hence. To manage the firm for an additional period, the entrepreneur incurs a personal cost of $280. The entrepreneur has declared that she wishes to file for bankruptcy and has contacted both the bank and the bondholder’s trustee. The bondholders wish to liquidate the firm immediately. What should the bank do? Why? Assume universal risk neutrality and a risk-free (discount) rate of zero. The entrepreneur owns all of the firm’s equity. How would the introduction of risk aversion by the participants alter your recommendations? Explain the effect on each participant.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

QUESTION 6b

You are a banker and are confronted with a pool of loan applicants, each of whom can be either low risk or high risk. A low-risk borrower will invest the $125 loan in a project which will yield $175 with a probability of 0.8 and $35 with a probability of 0.2 one period hence. A high-risk borrower will invest the $125 loan in a project that will yield $185 with a probability of 0.7 and $20 with a probability of 0.3 one period hence. You know that 55% of the applicant pool is low risk and 45% is a high risk, but you cannot tell whether a specific borrower is a high risk or a low risk. You are a monopolist banker. Everybody is risk-neutral. Each borrower must be allowed to retain a profit of at least $5 in a successful state in order to be induced to apply for a bank loan. The bank wants to obtain an expected return of 4%.

Determine the rate to charge and if the bank will offer the loans. Assume no project switching

QUESTION 6c

Consider the cost of funds – the risk-adjusted return on capital (RAROC benchmark) for a bank and identify some of the limitations of using this approach.

QUESTION 7a

Consider the following loan categories:

| Loan Type | Singapore Banks

Total ($b) |

Bank A ($b) | Bank B ($b) | Bank C ($b) | Bank D ($b) * |

| Real Estate | 3800 | 21 | 20 | 10 | |

| Commercial | 10200 | 171 | 24 | 12 | |

| Industrial | 3200 | 42 | 20 | 10 | |

| Consumer | 2800 | 18 | 16 | 8 | |

| Travel and Hospitality | 3000 | 20 | 30 | 15 | |

| Other | 5000 | 48 | 20 | 10 |

* Bank D is only investing in short-term government securities.

Which bank has the most diversified portfolio? Show all calculations

QUESTION 7b

Explain why the approach that you employed in Question 7a has benefits and limitations. Ensure that the benefits and limitations are justified and clearly explained. What impact would COVID -19 have on your answer?

QUESTION 8

Analyze the article, Koulouridi et al. (2020) “Managing and monitoring credit risk after the COVID – 19 pandemic” and compare and contrast the article with the specific material presented in the BUS308 Credit and Lending course. Please write within the space provided below

Buy Custom Answer of This Assessment & Raise Your Grades

A lot of Singapore university students can avail of our urgent assignment help on Banking & Finance Assignment and achieve a high rank. Our trained experts have a great ability to develop 100% plagiarism-free solutions on finance assignments. Our experts work round the clock to complete all assignments within the college or university deadline.

Looking for Plagiarism free Answers for your college/ university Assignments.

- INDIVIDUAL RESEARCH PROJECT: MERGERS AND THEIR IMPACT

- PSS388 End of Course Assessment January Semester 2025 SUSS : Integrated Public Safety And Security Management

- PSY205 Tutor-Marked Assignment 02 SUSS January 2025 : Social Psychology

- Math255 S1 Assignment-2025 SUSS : Mathematics for Computing

- BUS100 Tutor-Marked Assignment January 2025 SUSS : Business Skills And Management

- CSCXXX SUSS : New System Development Using Java : Soft Dev Pte Ltd Project

- Cloud Computing: Fundamentals, Networking, and Advanced Concepts

- COS364 Tutor-Marked Assignment January 2025 Sem SUSS : Interventions for At-Risk Youth

- FMT309 Tutor-Marked Assignment 01 SUSS January 2025 : Building Diagnostics

- HBC203 Tutor-Marked Assignment 01 January 2025 SUSS : Statistics and Data Analysis for the Social and Behavioural Sciences