| University | National University of Singapore (NUS) |

| Subject | Analytical Modelling |

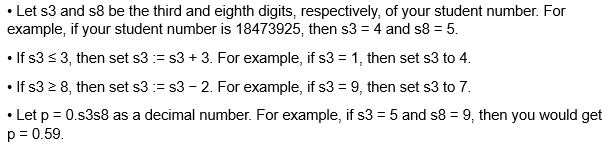

You will address a Decision Analysis problem as described below using the tools discussed in class, and make a recommendation to the decision maker. In this problem, you will notice that “the chance that the antidumping tax will be imposed is p, where p is derived from the third and eighth digits of your student number”. To find the p to use in your submission, work as follows:

AAA Electronics has contracted to supply half a million TabletPC systems to CostCoStores in 90 days at a fixed price. Each TabletPC system requires a High-Speed Northbridge chip (“HSN chip”) in order to function. In the past, AAA has bought these chips from a Korean chip manufacturer, Recce Chips.

However, AAA has been approached by a Chinese manufacturer, CAC Electronics, which is offering a lower price on the chips. This offer is open for only 10 days, and AAA must decide by then whether to buy some or all of the HSN chips from CAC. Any chips that AAA does not buy from CAC will be bought from Recce. Recce will sell HSN chips to AAA for S$3.00 per chip in any quantity. CAC will accept orders only in multiples of 250,000 HSN chips and is offering to sell the chips for S$2.00 per chip for 250,000 chips, and for S$1.50 per chip in quantities of 500,000 or more chips.

However, the situation is complicated by a dumping charge that has been filed by Recce against CAC. If this charge is upheld by the Singapore government, then the CAC chips will be subject to an antidumping tax. The judgment, in this case, will be delivered exactly two weeks from now and, if the charge is upheld, the antidumping tax will go into effect immediately. If AAA buys the CAC chips, these will not be shipped until 30 days from now, meaning the chips would be subject to the tax if the charge is upheld.

Under the terms proposed by CAC, AAA would have to pay any antidumping tax that is imposed. AAA believes that the chance that the antidumping tax will be imposed is p, where p is derived from the third and eighth digits of your student number as described above. If it is imposed, then it is equally likely that the tax will be 50%, 100%, or 200% of the sale price for each HSN chip.

- Draw a decision tree for this decision.

- Using the expected value as the decision criterion, determine AAA’s preferred ordering alternative for the HSN chips.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

At Singaporeassignmenthelp.com, we understand the challenges that students face when it comes to completing assignments on time. That's why we offer a wide range of assignment services that are tailored to meet your individual needs. From essay writing and research paper assistance to dissertation and thesis writing, we have the expertise and resources to help you achieve academic success.

Looking for Plagiarism free Answers for your college/ university Assignments.

- HRM331: Talent Management – Strategic Shift from the War for Talent to the Wealth of Talent

- Marginalised Populations – The Structural and Cultural Exclusion of People Experiencing Homelessness in Singapore

- CVEN3501 Assignment 2: Groundwater Modelling of Drawdown from a Pumping Bore

- CSCI312 Assignment 2: Conceptual Modelling and Implementation of a Data Warehouse and Hive Queries

- CH2123 Assignnment : Fugacity, VLE Modeling & Henry’s Law Applications

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- PSB501EN Assignment 1: Engineering Systems Integration: A Multi-Technique Approach to Mechanical Analysis

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Cinematic Dissection: Stylistic Elements and Their Thematic Significance

- Assignment: Transforming Talent in the AI Era: From War to Wealth through Ecosystem Innovation